The Strategic Utility of Advanced Trading Indicators & Investment Banking

Within the increasingly intricate architecture of contemporary financial markets—where algorithmic acceleration, high-frequency trading infrastructures, and intensified global interconnectivity converge—the ability to discern, interpret, and operationalize market signals with methodological rigor has become a defining determinant of sustainable profitability. Traditional reliance upon intuition, experiential heuristics, or technically outdated frameworks often precipitates maladaptive strategies, amplified volatility exposure, and unnecessary capital attrition. In this context, advanced trading indicators—particularly those embedded within the VIP Indicators suite—should not be conceptualized as mere auxiliary supplements but rather as epistemological instruments central to a new paradigm of financial decision-making. Their integration into professional practice represents a decisive epistemic transition: from discretionary guesswork rooted in subjective cognition to systematically validated, data-intensive methodologies capable of producing replicable strategic outcomes. Far from occupying a peripheral role, these indicators now constitute foundational mechanisms within the evolving ecosystem of digitally mediated trading.

Structural Challenges in Contemporary Trading

The operational environment of the modern trader is defined by an unprecedented confluence of systemic challenges. Volatility is increasingly driven by exogenous macrostructural events, ranging from geopolitical disruptions and regulatory realignments to algorithmically amplified liquidity cascades. Information asymmetries persist as institutional actors strategically withhold data advantages, leaving retail participants disproportionately exposed. Simultaneously, psychological fragilities—such as the prevalence of cognitive overconfidence, paralysis induced by data saturation, and decision fatigue generated by continuous market surveillance—compromise rational execution. While market participants ostensibly have access to massive volumes of real-time data, the interpretive challenge lies in disentangling actionable signals from the pervasive background noise. Conventional instruments, often lagging in responsiveness or internally contradictory, frequently exacerbate epistemic confusion rather than resolve it. These deficiencies underscore the necessity for algorithmically enhanced analytical systems capable of transforming raw informational inputs into coherent, strategically relevant insights.

VIP Indicators: A Market Disruptor in Analytical Democratization

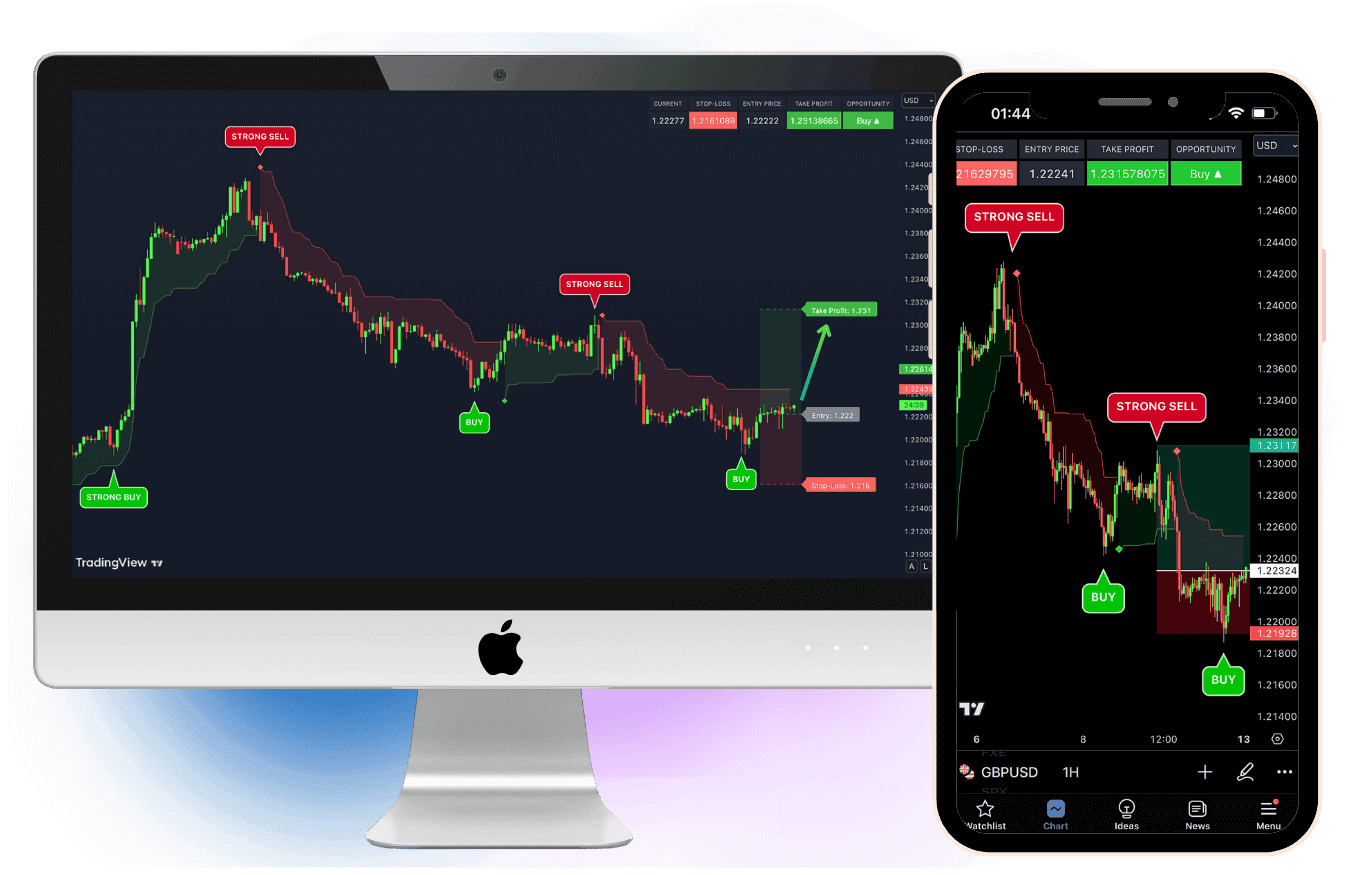

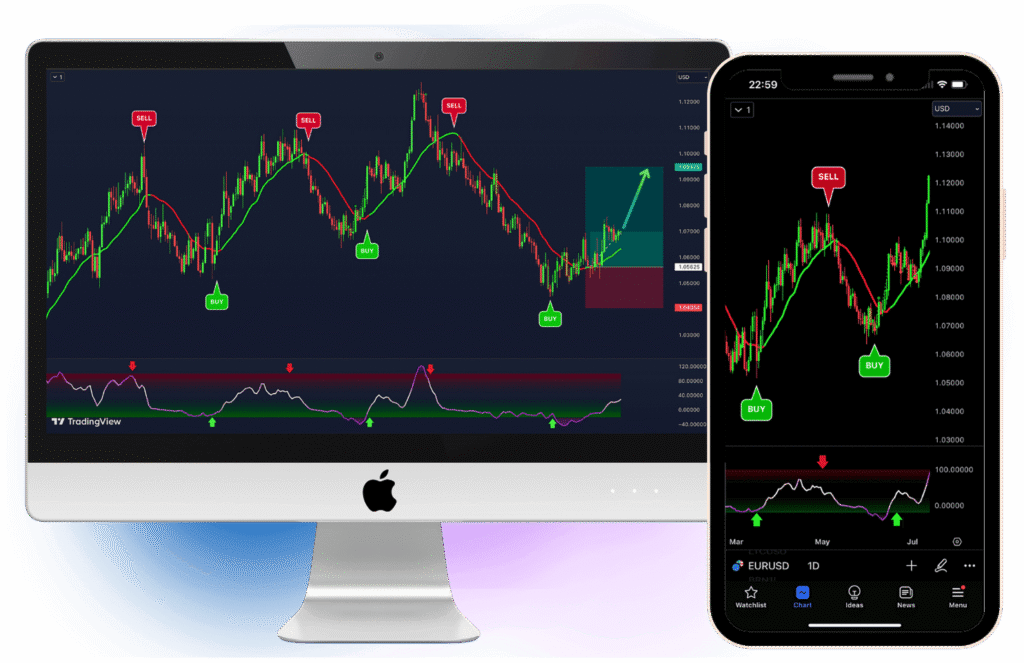

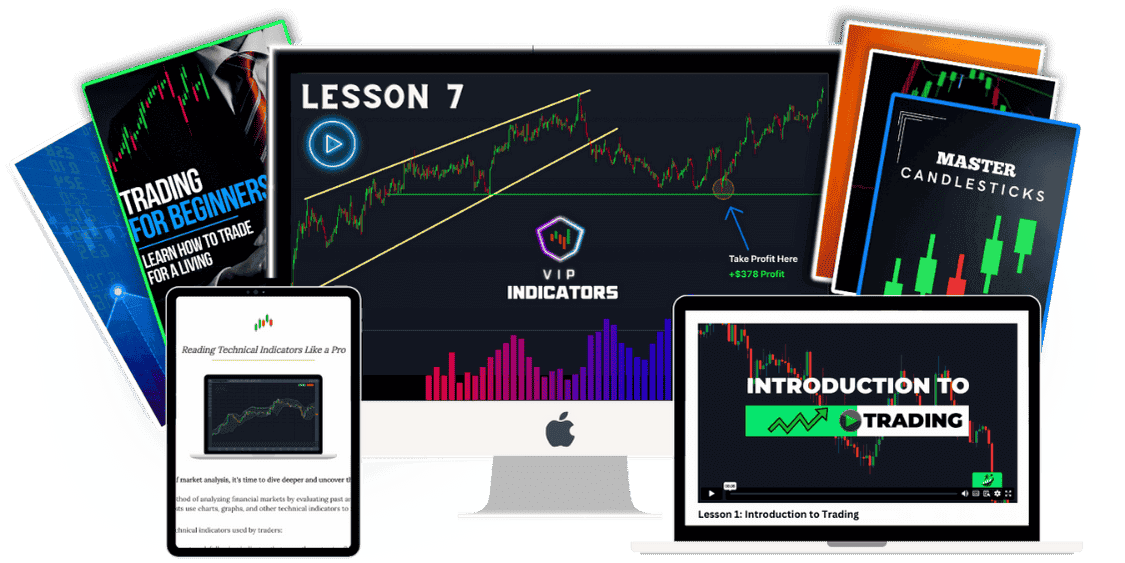

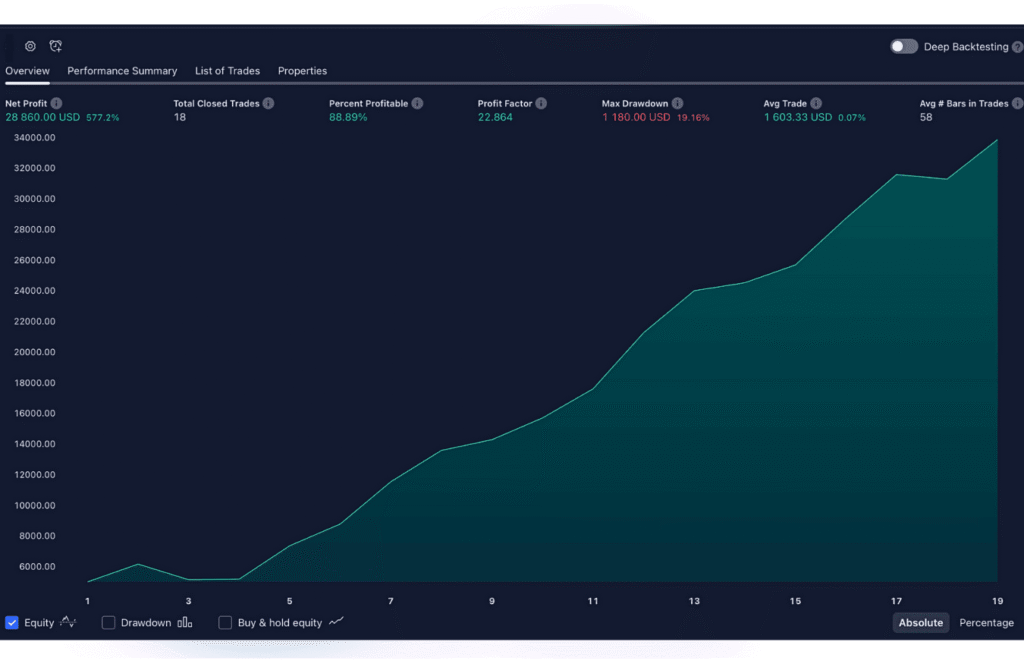

The VIP Indicators framework operates as both a technological advancement and a democratizing intervention in the trading landscape. Constructed upon sophisticated algorithmic architectures but optimized for accessibility, it transforms high-frequency, heterogeneous data flows into intelligible and actionable insights. Its design emphasizes clarity, usability, and interpretive transparency, thereby mitigating the analytical opacity characteristic of institutional-grade systems. Significantly, it demonstrates cross-market adaptability—across foreign exchange, commodities, cryptocurrencies, and equities—enabling traders to unify strategic methodologies within diversified portfolios. This accessibility signals a paradigmatic disruption: advanced analytical power, once sequestered within elite institutional domains, is increasingly redistributed to individual traders, thereby correcting long-standing epistemic asymmetries without diminishing methodological rigor.

Core Benefits and Propositional Value

Refined Precision in Market Entry and Exit – Delivers high-fidelity buy and sell signals, reducing reliance on subjective heuristics while minimizing executional stochastic error.

Cross-Market Applicability – Ensures strategic consistency across asset classes, supporting risk-hedged portfolio diversification under a unified analytical framework.

Democratized Accessibility – Embeds institutional-grade analytics within an interface designed for practitioners of varying expertise, thereby lowering barriers to methodological sophistication.

Integrated Risk Governance – Incorporates mechanisms for proactive downside mitigation, ensuring that profitability is tethered to principles of capital preservation and sustainability.

Cognitive Efficiency and Temporal Optimization – Automates interpretive processes, reducing monitoring burdens and conserving cognitive resources for strategic decision-making.

Pedagogical Functionality – Provides structured, interpretable signals that accelerate novice education while reinforcing disciplined, systematic trading habits.

Cultural and Psychological Dimensions of Adoption

The integration of advanced systems such as VIP Indicators carries profound implications beyond technical efficacy, extending into psychological resilience and cultural redefinition within trading practices. One of the principal impediments to sustained profitability remains emotional volatility, manifesting in impulsive risk-taking or immobilizing indecision. By anchoring decision-making within algorithmically disciplined clarity, such systems attenuate the influence of cognitive biases and psychological fragility. At the cultural level, the proliferation of VIP Indicators is nontrivial: it embodies a redistribution of analytical power, challenging the monopolistic concentration of institutional elites and affirming a narrative of decentralization and empowerment. In so doing, it signals a reconfiguration of the epistemic hierarchies underpinning financial practice.

Critical Considerations and Epistemic Limits

Despite their sophistication, it is imperative to underscore that no indicator system, however advanced, can eradicate the intrinsic uncertainty of financial markets. Their predictive efficacy is conditioned by practitioner discipline, the robustness of risk governance protocols, and exogenous macroeconomic contingencies. Advanced indicators increase probabilistic accuracy but do not immunize traders against systemic shocks or structural dislocations such as regulatory interventions, liquidity crises, or deliberate market manipulation. Optimal utility, therefore, arises from their integration within comprehensive frameworks that synthesize algorithmic insight with ongoing education, capital conservation strategies, and vigilance toward shifting systemic conditions. True strategic resilience emerges from the synergy between disciplined human judgment and algorithmic precision.

Conclusion: Toward a Reframed Paradigm of Trading Practice

The VIP Indicators suite exemplifies the broader trajectory of trading technology’s evolution: from opaque, institutionally sequestered architectures toward transparent, democratized systems that empower a global community of traders. For practitioners seeking methodological rigor, cognitive stability, and operational autonomy amid escalating market volatility, such systems constitute indispensable resources. Yet their ultimate significance lies not solely in their technological sophistication, but in their function as catalysts for a redefined trading culture grounded in knowledge-intensive, disciplined practice. By reconciling accessibility with analytical rigor, VIP Indicators transcend their status as mere technical artifacts; they represent a decisive step toward a trading paradigm wherein individual agency, systemic efficiency, and epistemic empowerment converge.